MyFICO Premier identity theft protection review

Our Verdict

MyFICO monitors your credit and explains your credit scores better than any competitors. But it offers only bones identity-theft-protection and fraud detection.

For

- Tops in credit monitoring

- Uses FICO credit scores

- Monthly iii-bureau credit reports

Against

- Lacks the latest identity-theft-protection features

- Quite expensive

Tom's Guide Verdict

MyFICO monitors your credit and explains your credit scores meliorate than any competitors. But it offers merely basic identity-theft-protection and fraud detection.

Pros

- +

Tops in credit monitoring

- +

Uses FICO credit scores

- +

Monthly 3-bureau credit reports

Cons

- -

Lacks the latest identity-theft-protection features

- -

Quite expensive

MyFICO Premier: Specs

Frequency of credit reports: Monthly

Frequency of credit scores: Monthly

Credit-improvement simulator: Yes

Address-change monitoring: No

Data breach alerts: No

Investment business relationship monitoring: No

Medical records monitoring: No

Payday loan monitoring: No

Sex activity offender warning: No

Security software: None

Title-change alerts: No

Two-factor authentication: No

MyFICO Premier offers the best credit monitoring of whatever service we've tested. But it's not primarily an identity-theft-protection service, and in fact offers only the basics of identity monitoring and fraud detection. Instead, it'due south best for customers who want to concentrate on their credit scores.

What MyFICO does requite y'all is monthly access to credit reports and the FICO credit scores derived from them, besides as how those scores are calculated and what you tin can do to modify them.

FICO scores are used by almost lenders to determine your creditworthiness for loans, credit cards and mortgages. Other services show you lot credit scores that endeavor to match FICO scores, but MyFICO gives you the real deal.

In terms of identity theft protection, MyFICO is solid just not the best. It monitors your bank accounts, court records and the "dark web," but it can't take hold of address changes, home-title theft or data breaches and offers no protection from malware or phishing.

We'd give MyFICO Premier a higher rating every bit an identity-theft-protection service if information technology had a few more of those abilities. Equally a credit-monitoring service, it tin't exist beat.

For the best identity-theft protection, try IdentityForce or LifeLock. Merely if yous care more about your actual FICO credit scores than annihilation else, then MyFICO will deliver.

Read on for the balance of our MyFICO review.

MyFICO: Costs and what'southward covered

An adjunct of Fair Isaac Corp (aka FICO), the originator of modern American credit scores, MyFICO focuses on FICO credit scores and ignores some of the mainstays of identity protection. That makes it practiced if yous want information pertinent to taking out a loan, merely bad if you desire a full suite of identity-theft-protection services.

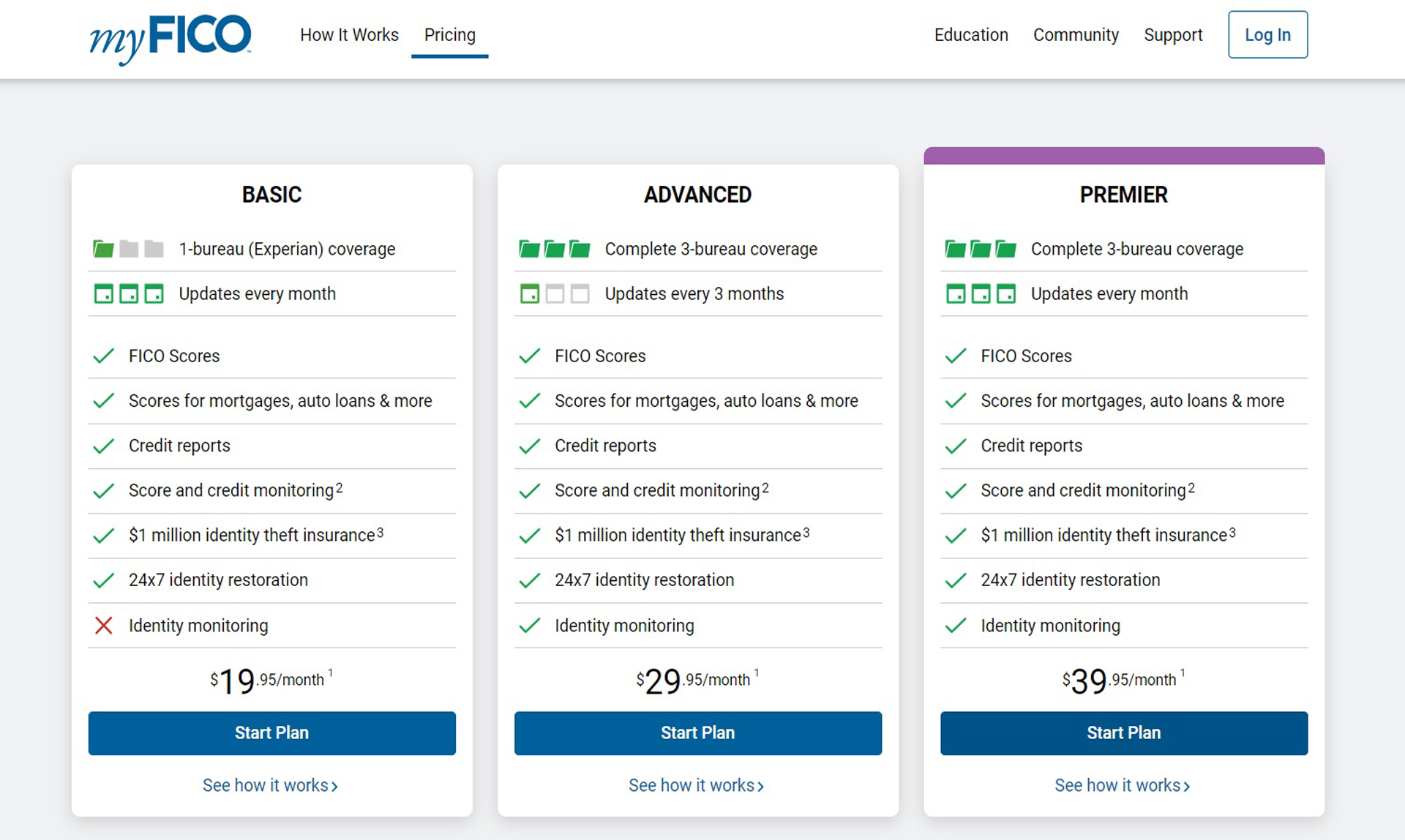

MyFICO has three service plans, starting with the $20-a-month Basic programme. It includes access to 10 different FICO credit scores, including those used for mortgages, automobile loans and credit cards. You lot get monthly credit reports from Experian besides as monthly FICO credit scores and alerts if there are whatever changes.

The Bones programme includes $i million of insurance to restore your credit and identity if it is stolen while on MyFICO's watch. Notwithstanding, it lacks any monitoring of identity information, such equally whether some of your data is being offered for sale in "dark web" marketplaces.

MyFICO'southward Advanced programme costs $xxx a month. It includes full credit reports from the big 3 credit bureaus — Equifax, Experian and TransUnion — as well as the 28 well-nigh used FICO indicators. The credit reports arrive quarterly, and the service also includes monitoring of your personal information on the open and dark spider web.

That frequency of credit reports and scores is unusually generous for a mid-priced plan in this category. But IdentityForce's height-end plan gives you similar credit monitoring plus more than identity-theft-protection features for $24 a calendar month.

There's also a Family version of the MyFICO Avant-garde plan that covers ii adults and as many as ten children up to age 18 for $fifty a month. Past dissimilarity, Identity Strength's unlimited family plan costs $14 less.

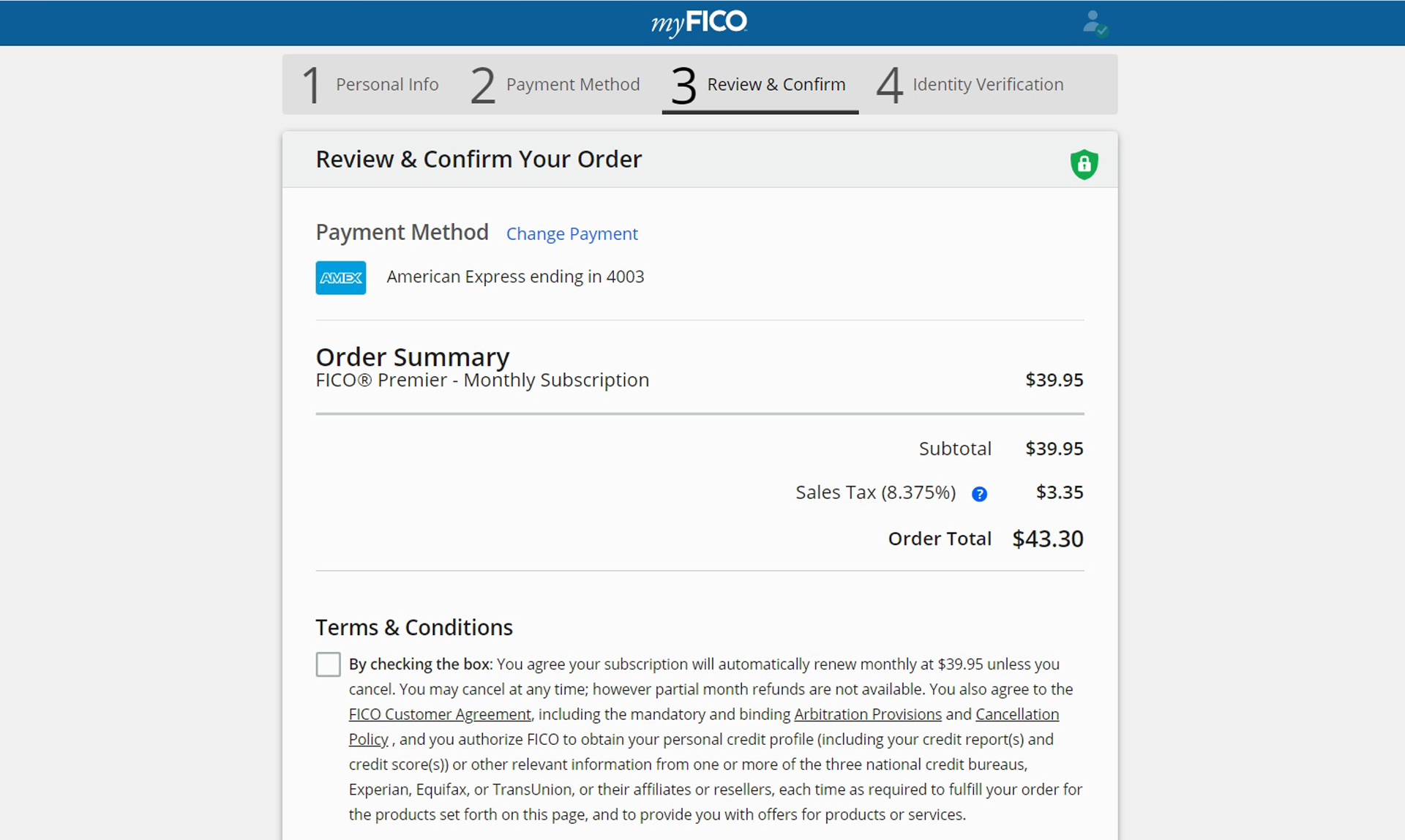

The Premier plan is MyFICO'due south most expensive plan.,At $twoscore a month, it costs more than any other credit-monitoring or identity-theft-protection plan we've reviewed. MyFICO Premier ups the frequency of credit reports from quarterly to monthly but otherwise matches the Advanced plan.

All of the MyFICO plans get sales tax added to the advertised price, in my case eight.25%. In that location'south no discount for paying for a year at once, and as a effect, MyFICO Premier will run you lot $480 per twelvemonth. LifeLock Ultimate Plus, which includes the full Norton 360 Deluxe security suite and has many more identity-monitoring tools, although far less credit monitoring, goes for an annual $350.

MyFICO has an A+ rating from the non-profit Amend Business concern Bureau. When we last looked, there were 27 complaints, about of which had detailed responses from the company. MyFICO rated a 3.25 out of five from ConsumerAffairs, which is paid by some of the companies whose products it reviews.

| MyFICO Basic | MyFICO Advanced | MyFICO Premier | |

| Monthly cost | $20 | $thirty | $40 |

| Yearly cost | $240 | $360 | $480 |

| Family plan | None | $50, two adults & up to x kids | None |

| Credit reports provided | Experian | Equifax, Experian, TransUnion | Equifax, Experian, TransUnion |

| Credit bureaus monitored | Experian | Equifax, Experian, TransUnion | Equifax, Experian, TransUnion |

| Frequency of credit reports & scores | Monthly | Every iii months | Monthly |

| Type of credit score | FICO | FICO | FICO |

| Credit-improvement simulator or advice | Yes | Yeah | Yeah |

| Bank, card accounts monitored | No | Yeah | Yep |

| Black-market ("dark web") monitoring | No | Yep | Yep |

| Lost wallet assistance | Aye | Yeah | Yes |

| Court record monitoring | No | Yes | Yes |

| Max. ID-theft coverage | $i 1000000 | $1 million | $1 1000000 |

MyFICO: How we tested

In the late summer of 2020, I signed upwardly with five of the biggest identity-theft-protection services, including the MyFICO Premier service program. All were paid for past me and reimbursed by Tom's Guide.

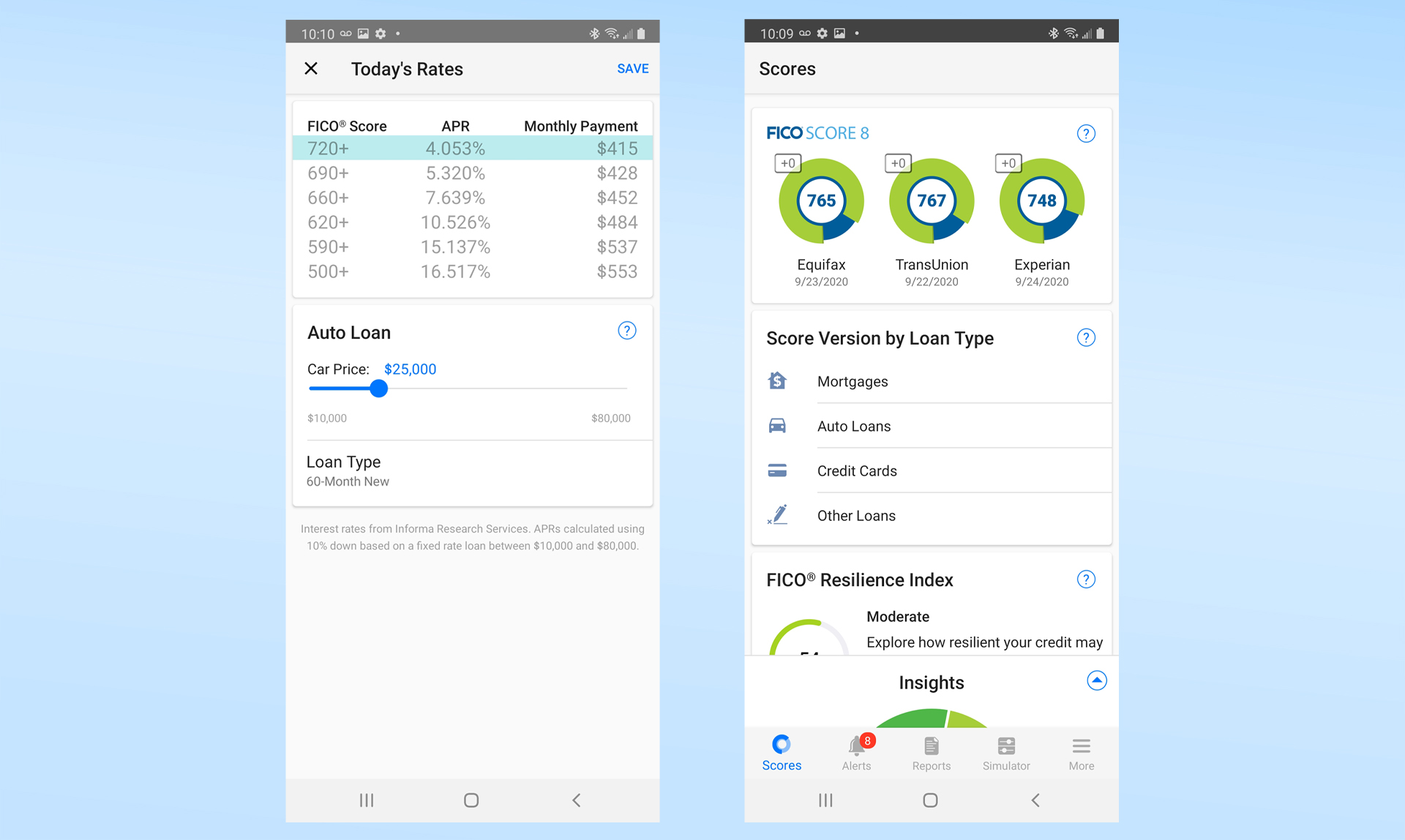

After I installed the MyFICO mobile app on my Samsung Galaxy Note 20, I logged on most days over the course of 3 months. In addition to checking on Premier'south alerts, notifications and changes to my credit and identity, I checked my credit scores.

I used the credit simulators and utilities, only as MyFICO doesn't include antivirus or security software on any of its plans, I couldn't evaluate those. Finally, I checked in with each company'southward back up staff and recorded how long it took them to respond. At the end, I canceled the service.

MyFICO: Credit scores and monitoring

The MyFICO services focus sharply on FICO credit scores and monitoring. Few other identity-theft-protection or credit-monitoring service provides your bodily FICO scores, which most banks and other lenders employ to determine your creditworthiness. FICO scores are accessed millions of times a day and are key indicators for 90% of U.South. lending decisions.

Most identity-theft-protection services instead utilise the VantageScore 3.0 credit scores, issued by a visitor jointly owned past the Big Three credit bureaus Equifax, Experian and TransUnion. VantageScore 3.0 scores but approximate FICO scores simply are sometimes used by lenders.

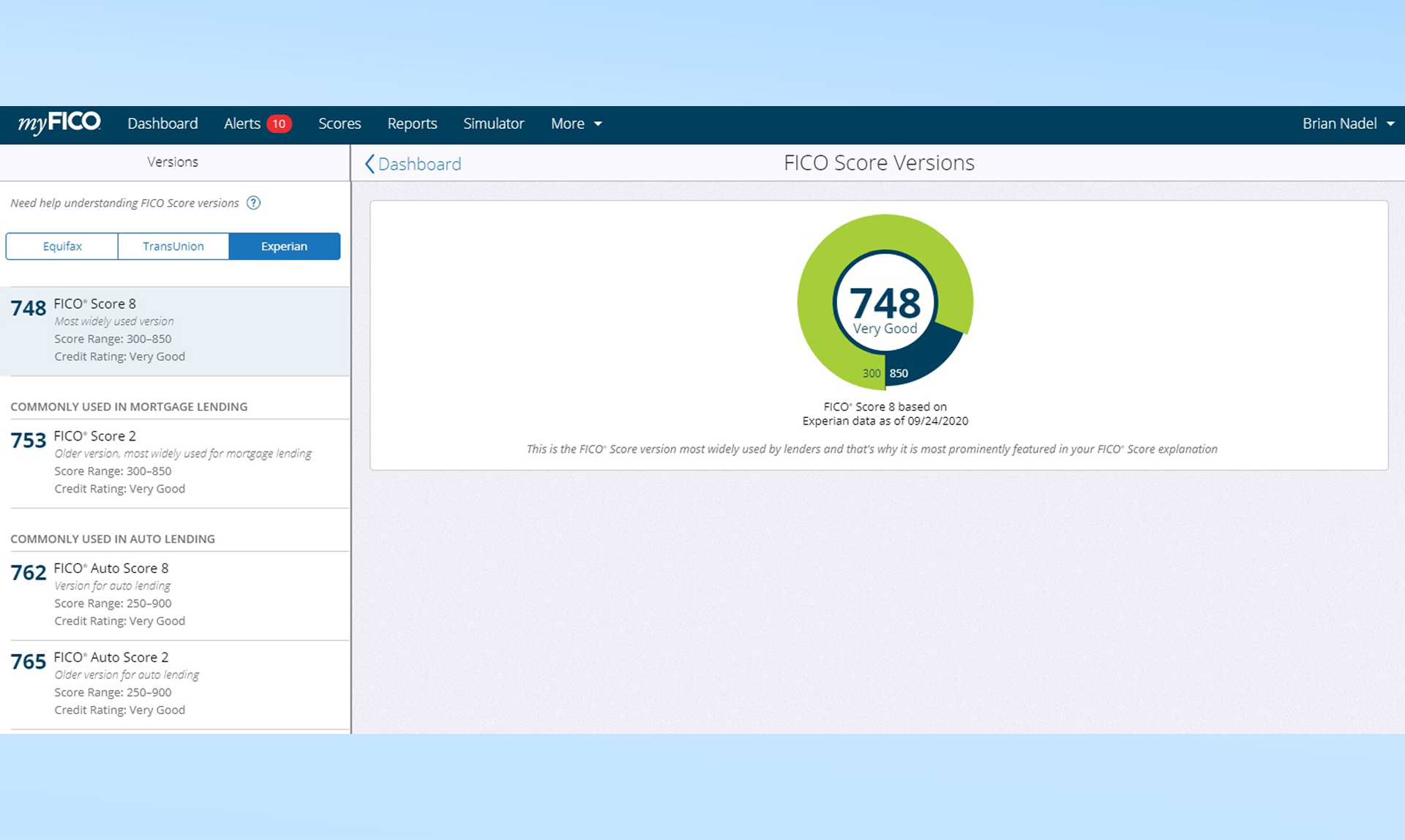

Because FICO provides more two dozen credit scores, it can be a bit much for the uninitiated. For example, the FICO 2, iv and five scores use data from Experian, TransUnion and Equifax, respectively, for banks to determine creditworthiness for a mortgage.

The FICO 8 score uses information from all three credit bureaus and is for car loans and credit cards. The FICO ix score is new and is growing in popularity. MyFICO shows you all these and other FICO scores.

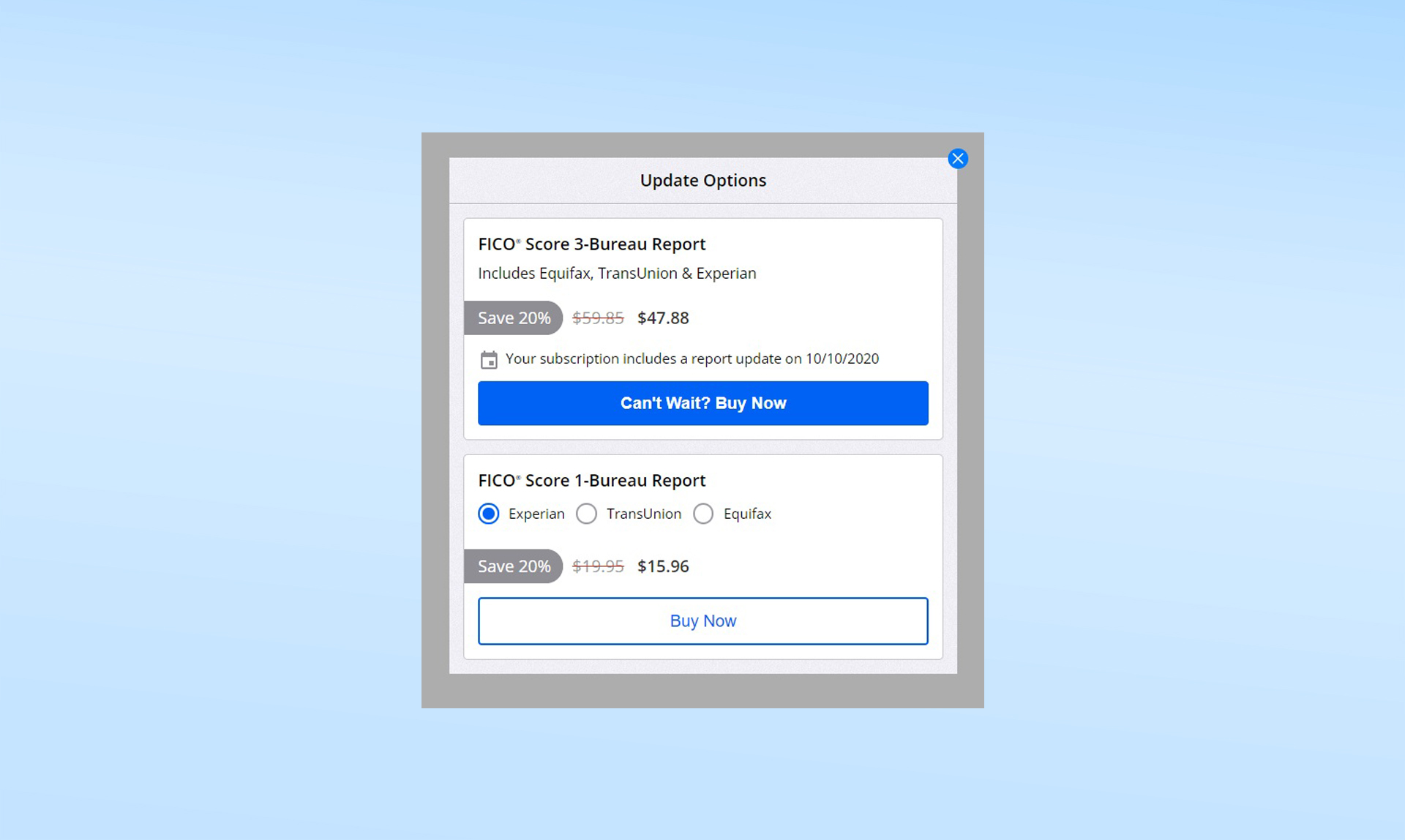

With the MyFICO Premier program, yous go access to the full credit reports from all three credit bureaus every month. Most identity-theft-protection services provide credit reports merely annually or quarterly. MyFICO as well lets you lot purchase instant reports — $sixteen for a single bureau's report or $48 for all three.

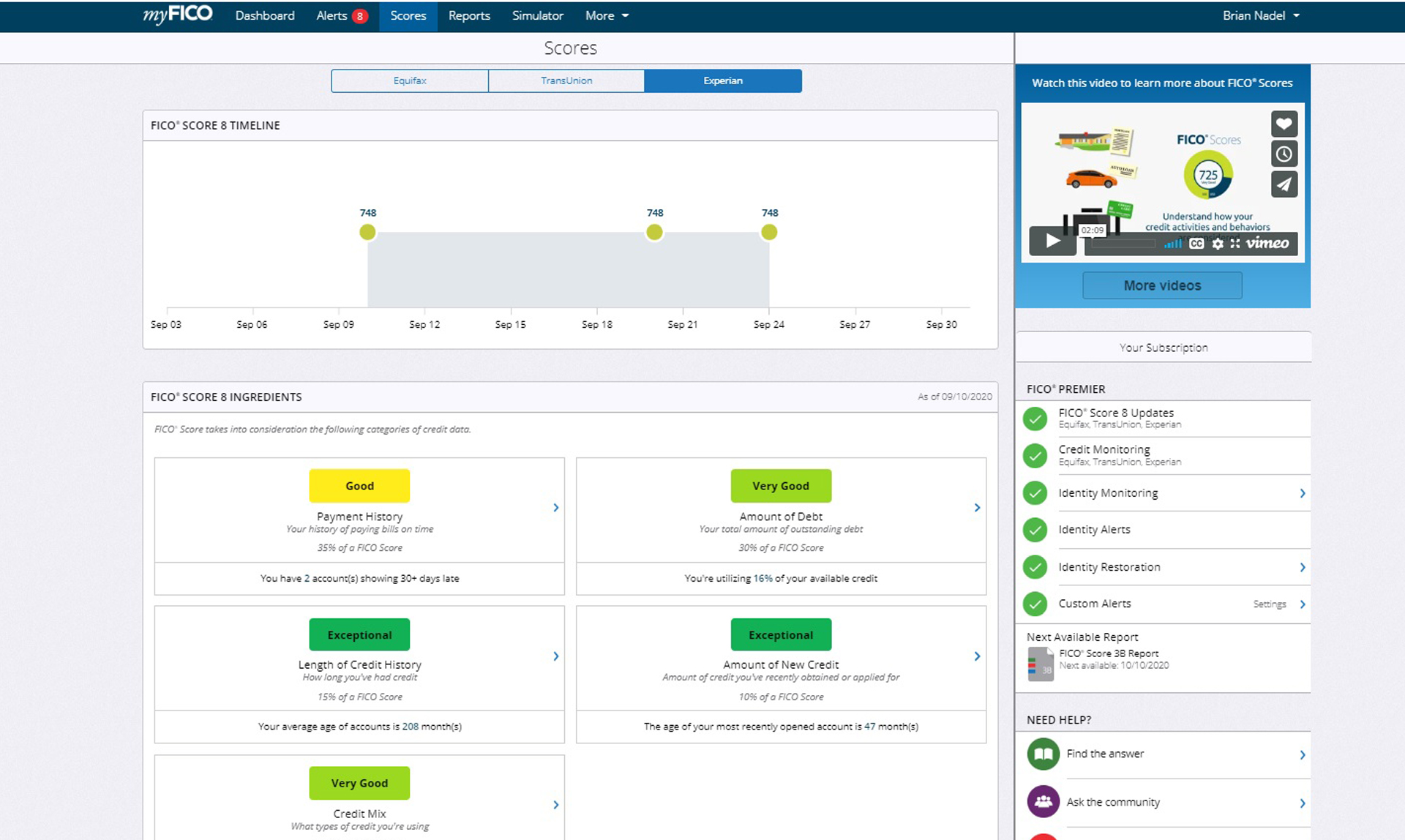

Almost identity-protection service have a credit-score tracker that graphs your credit ratings over time, but MyFICO adds a twist. It provides an appraisal of the ingredients that go into each FICO score to provide more insight into how the scores are formed. These factors can include payment history, debt load, length of credit history and the mix of credit sources.

The MyFICO Advanced and Premier plans keep an eye out for instances of your personal information showing upwardly online and on the dark Spider web. They monitor public records, such country and federal courtroom proceedings, and can spot sudden changes in your credit-card balances every bit well every bit new accounts created in your name. Merely they don't track act or championship changes for your domicile and can't meet if someone has changed your address with the U.S. Postal Service or filed tax returns in your proper name.

MyFICO: Insurance and services

Like many of its peers, MyFICO seeks to help y'all with lawyers, investigators and experts to get your identity and credit back in example your identity is stolen nether its watch. It also has a $1 1000000 insurance policy, underwritten past American Bankers Insurance Visitor of Florida, that tin be usedto recover lost funds that a bank or credit card company won't encompass.

The insurance policy tin can also reimburse you for expenses for travel, certificate notarization and loss of wages related to your instance. MyFICO will pay y'all for your entire bodily lost acquirement up to the policy limit.

MyFICO: Notifications and alerts

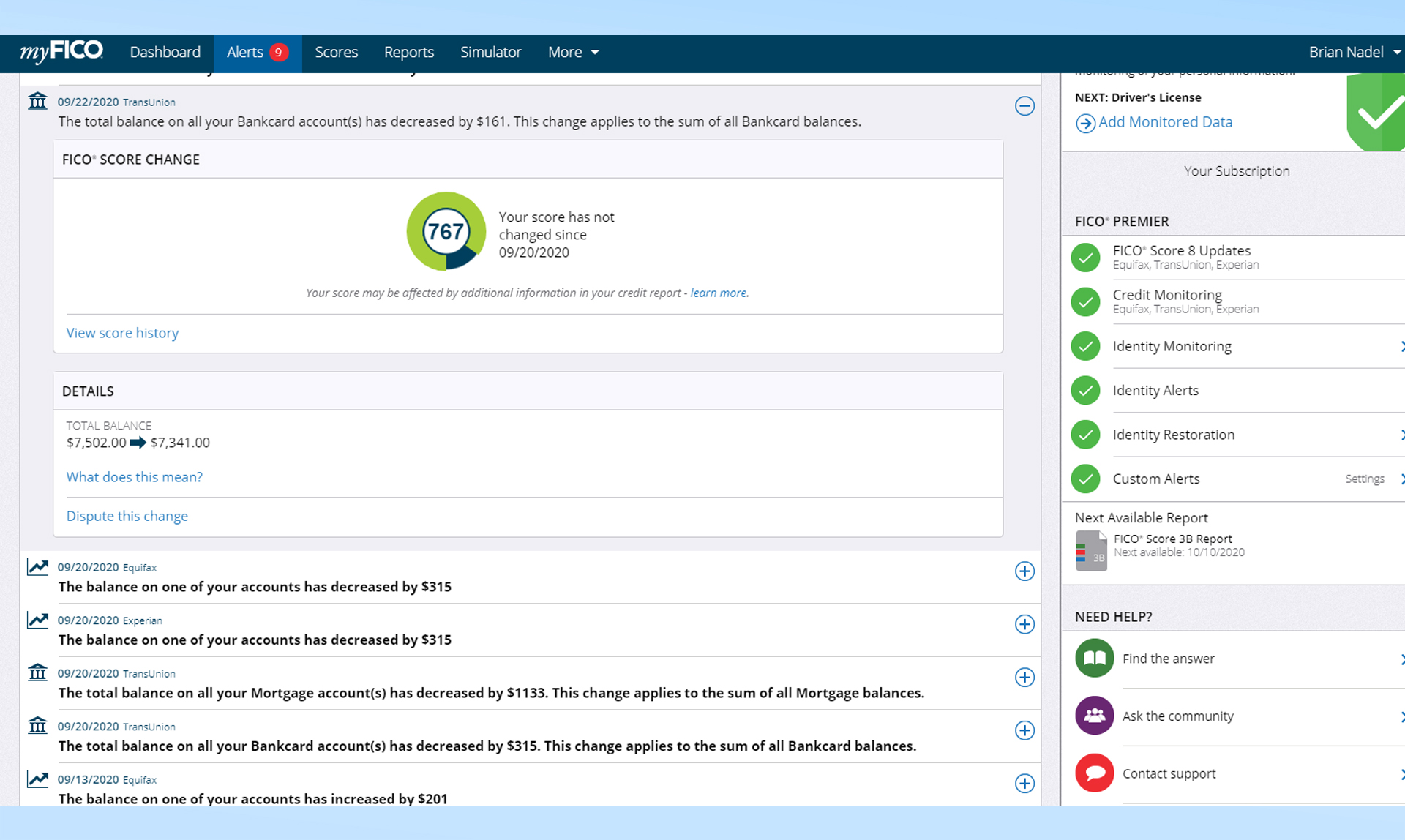

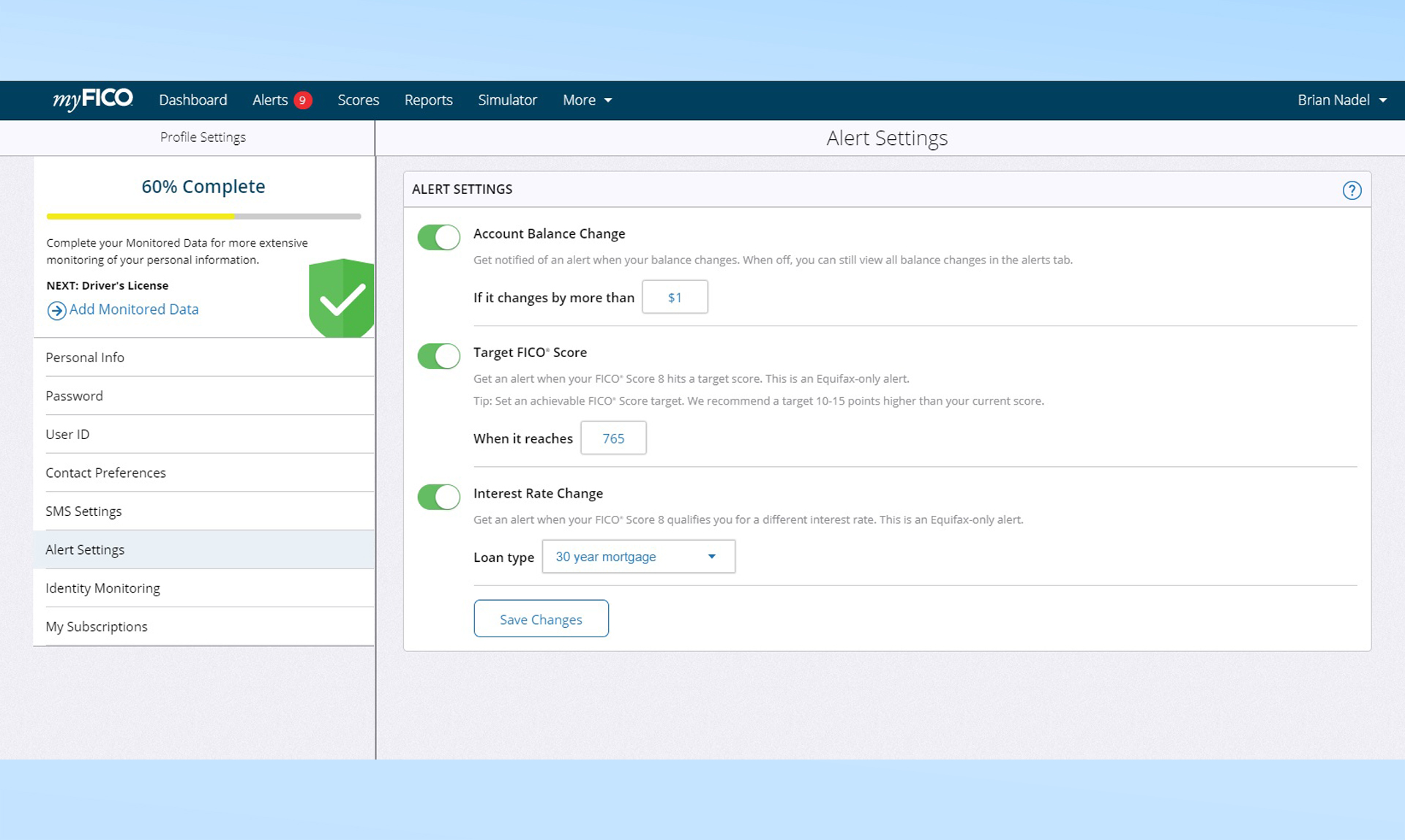

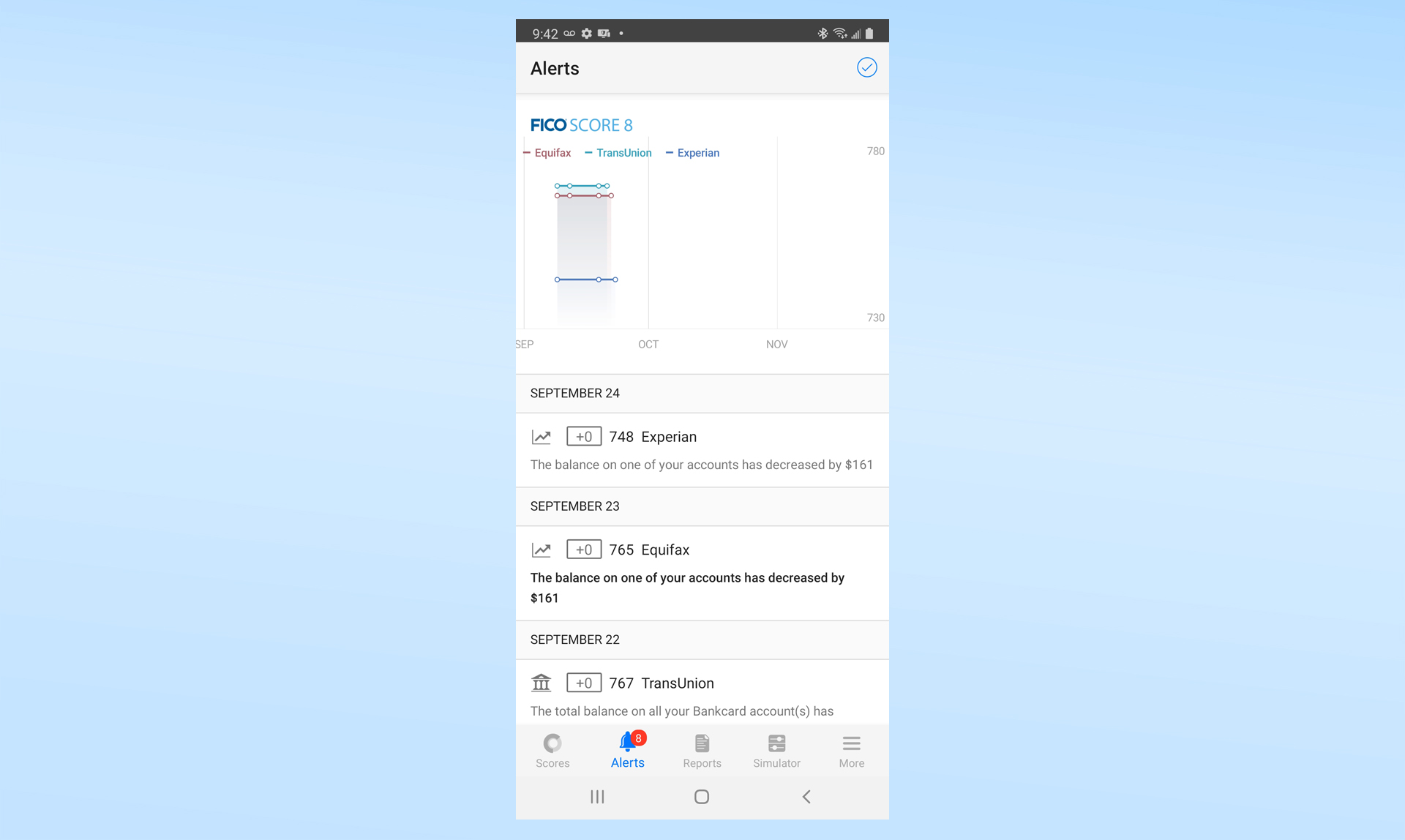

MyFICO posts alerts for you in its desktop-browser interface and its mobile apps, but also sends SMS text-message alerts to your cellphone number as well as emails. Nevertheless, it plans to phase the texted alerts out due to depression demand, which is a shame because those kept me focused on the alerts. The service's notifications were the most detailed of the v identity-theft-protection services we've recently reviewed.

Be warned — the alerts can be overwhelming. Over my three-month test period, I received dozens of notices from MyFICO that my credit-carte du jour balance was rising while my bank account was falling. The alerts more often than not came in batches of iii — ane from each credit bureau.

Unfortunately, MyFICO's default setting is to ship out an alarm if any account balance changes by $1. Once I figured this out, I adjusted the threshold and was less often bothered.

MyFICO as well has a hidden bonus quirk that might help anyone because refinancing a mortgage. Its Custom Alerts section tin exist set to send an warning when your FICO score changes to authorize you for a lower interest rate.

Overall, I received 54 alerts from MyFICO via the online interface, texts and the mobile app over the grade of three months, by far the virtually alerts of any of the 5 identity-theft-protection services I recently reviewed. All the alerts from MyFICO were specific, although some were puzzling at first. Setting up a mortgage yielded credit inquiries from Factual Data, a visitor that works as a data banker for the credit agencies, but the alert made no mention of the words "mortgage" or "loan". In that location's a link in the MyFICO alert notifications to dispute a change.

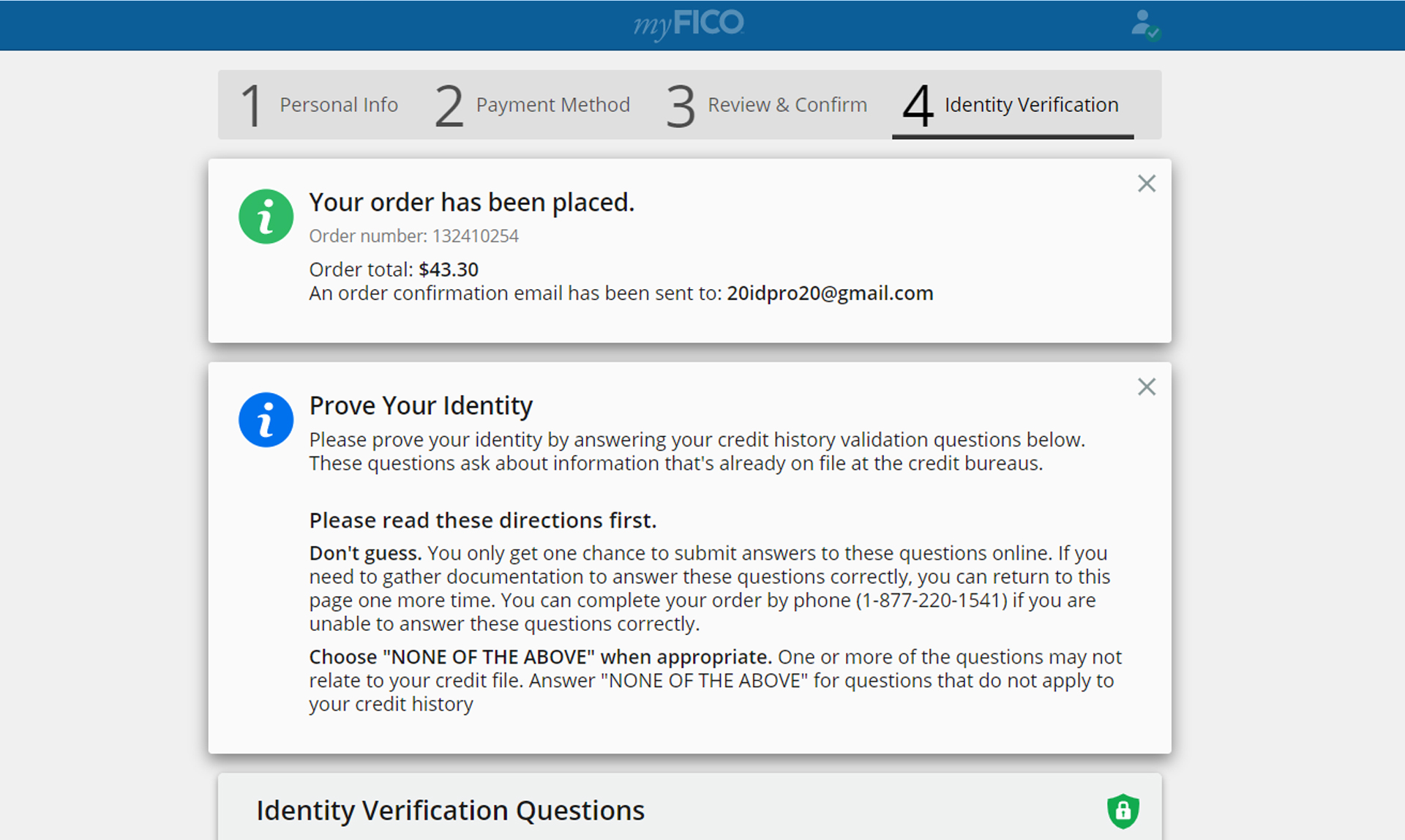

MyFICO: Setup

Getting started with MyFICO was generally efficient, simply a couple of glitches got in my way and the entire setup process took more than than an hr. Subsequently I went to the MyFICO site and picked the Premier plan, I needed to enter an email address and password for the business relationship. If you don't want to receive promotional and marketing cloth from MyFICO, exist sure to click the opt-out box.

I and so needed to fill in my personal information, but the MyFICO site balked at letting me enter the town and state I alive in; it took two tries to finally get it to work. The site wanted payment information from a credit card or PayPal account, and I filled in my data.

Unfortunately, the payment information got caught in a processing loop and I gave upwardly after 15 minutes. I sent MyFICO's tech-support people an electronic mail and got a answer that the payment was not complete and to try once more. I did and ii minutes later, information technology was accustomed.

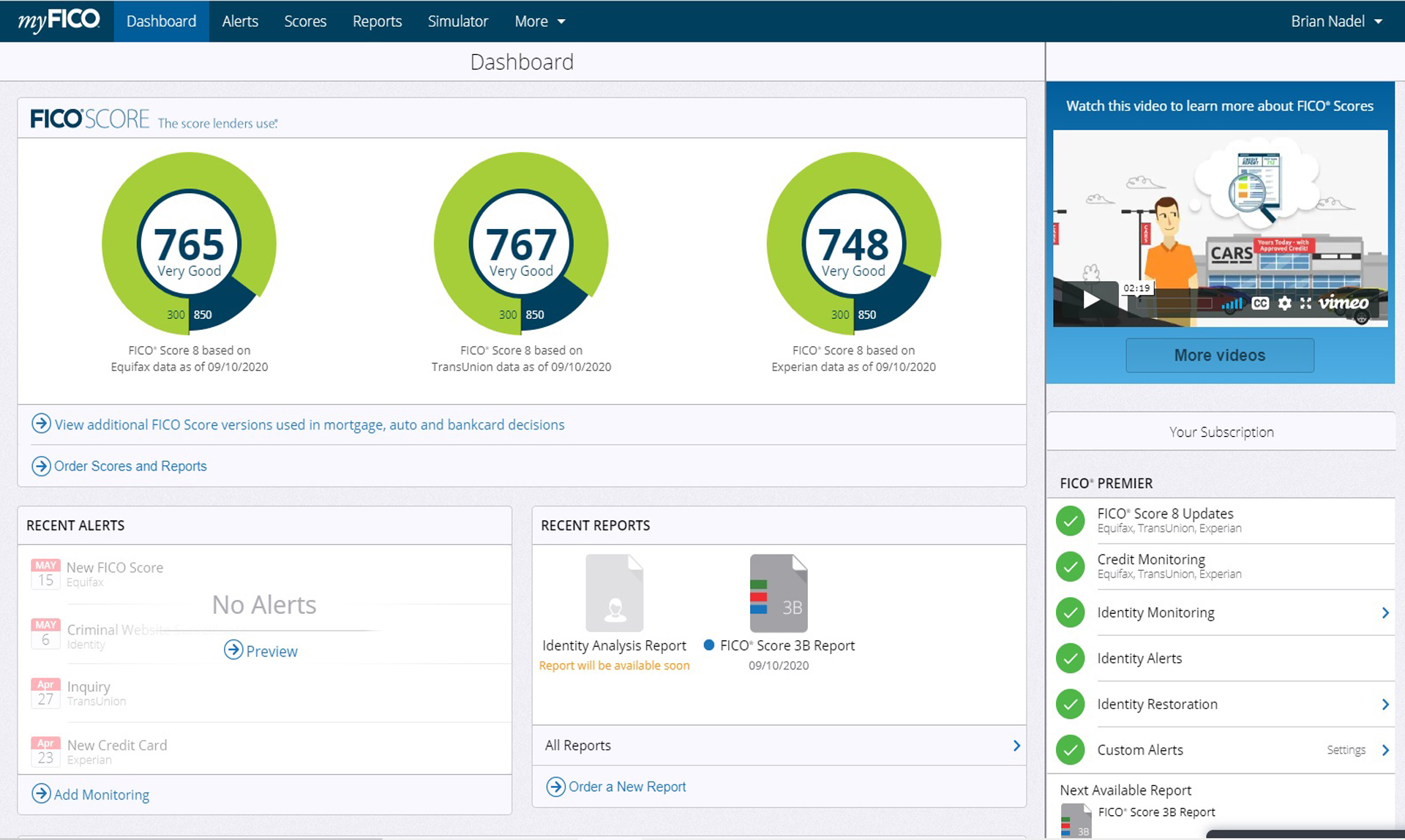

I at present had to prove my identity by answering four questions about my life, including queries about past and present addresses, mortgages and credit cards. I passed and was sent to the service's Dashboard, which showed me my FICO scores for all 3 bureaus. The whole procedure took i hour and xv minutes, although my issues might have been unique.

The good news is that, according to MyFICO, all my personal data was transported back and forth and saved in encrypted form. The company promises to wipe all your information subsequently counterfoil, just it lacks ii-factor authentication to protect your account in instance someone steals your password.

MyFICOs has identity-restoration experts on call 24/seven, merely its full general customer-back up crew is available only Monday through Friday from half dozen:00 a.m. to 6:00 p.m. (Pacific time) and Sat from 7:00 a.m. to 4:00 p.1000. The site has informational videos about the MyFICO the service, including i most how the FICO score is generated.

There's a direct link from the MyFICO browser interface to the support site and a quick manner to send customer back up an email. On the other hand, the customer-support phone number is particularly well hidden on the website, and it took customer support three.5 hours to respond to a pricing problem I had.

MyFICO: Interface and utilities

MyFICO combines a thorough online interface with a good mobile app, and both provide like information. The app requires the use of a PIN, a fingerprint or facial recognition to use, while the online version requires a full log in with the account'due south username and password.

That said, MyFICO's browser-based interface needs to be zoomed out to 50% or scrolled up and down a lot to run across all the information presented. The principal Dashboard page lists your FICO 8 scores along with the data they're based on. Below that is access to other FICO scores. Click on any of them and you lot'll detect a nice tracker and overall appraisal of your creditworthiness. The Dashboard also lists recent alerts and credit reports.

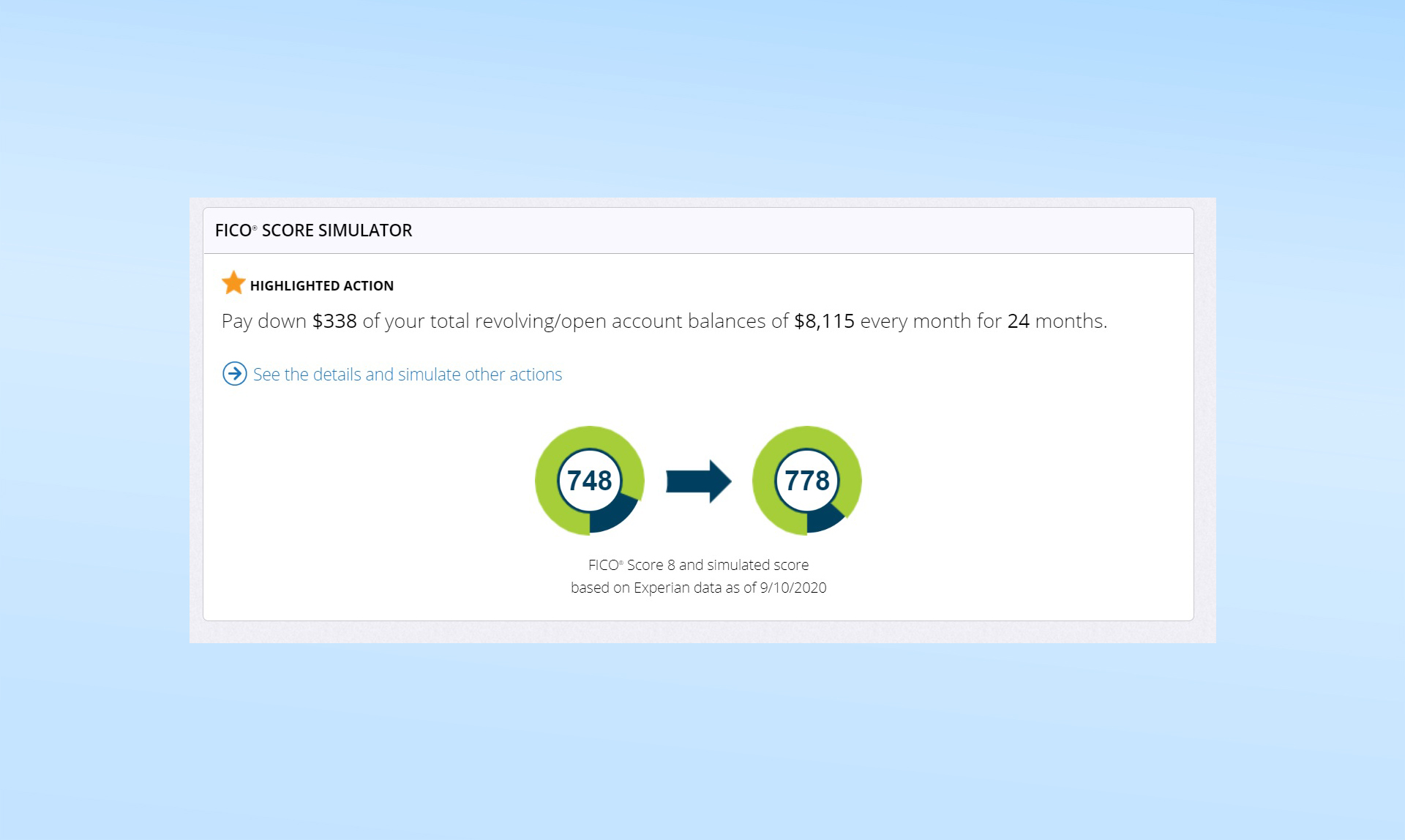

MyFICO'southward killer feature is its FICO Score Simulator. Other identity-protection services tin only judge most the secret sauce that's used to turn raw credit data into a real FICO score, simply MyFICO knows the exact algorithms.

In other words, MyFICO tin accurately model changes to predict your resulting credit score more closely and also proactively requite yous tips. For example, rather than waiting for me to submit possible changes and then telling me what my credit score might exist afterward, the MyFICO simulator suggested that I lower my credit-menu rest past $338 to raise my credit score past 30 points.

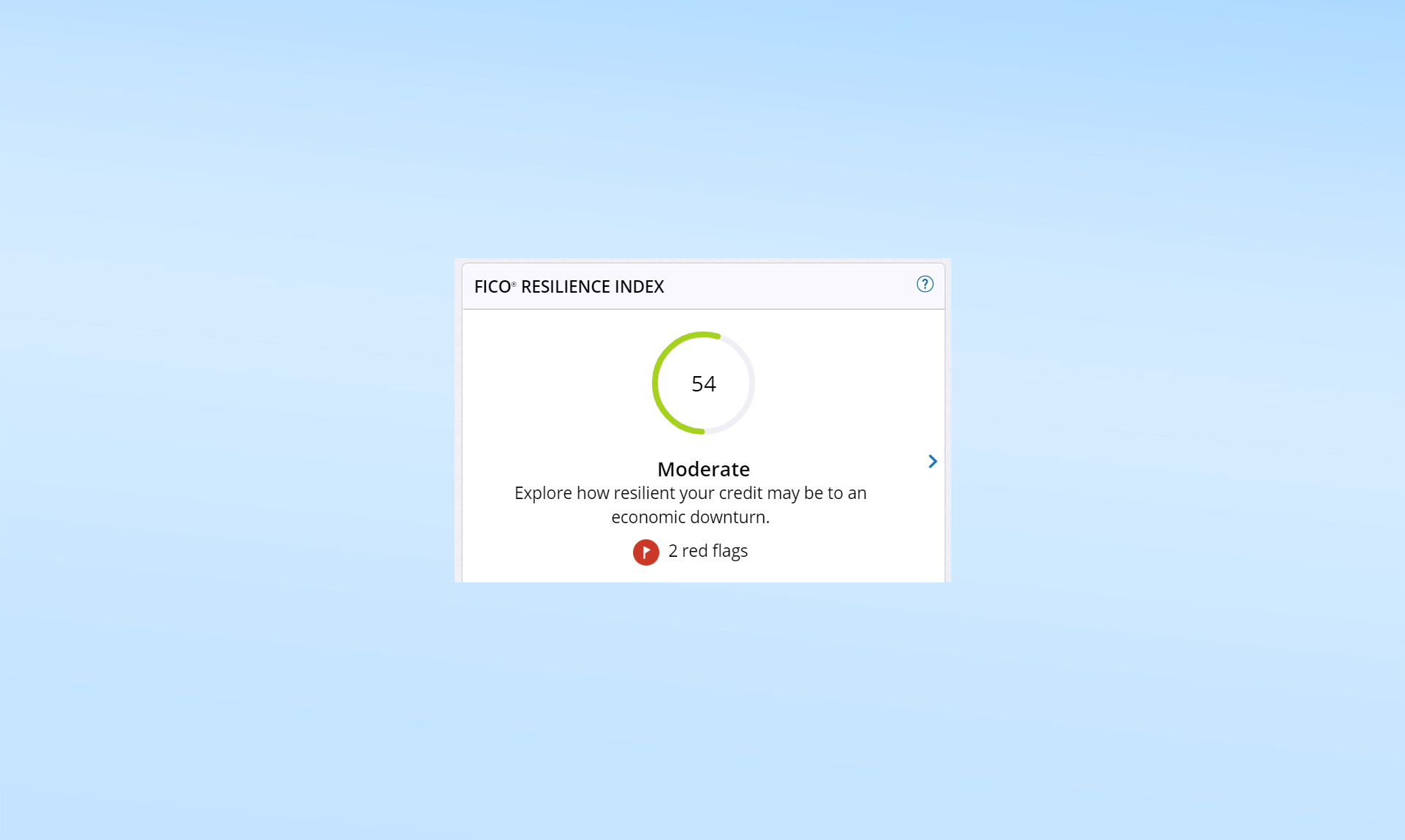

The FICO Resilience Index is used by lenders to assistance predict how resilient a person's credit may exist in the outcome of an economical downturn. It showed two red flags about my credit that might affect my score.

On the downside, MyFICO lacks extra security software like LifeLock'southward Norton 360 antivirus suite or Identity Guard'due south browser extensions. If you're happy with your existing security software, then this will be fine, only those extras provide an additional layer of protection, oft at a disbelieve, to anyone who doesn't already have them.

MyFICO'south Android and iOS apps squeeze a lot into a small screen. Along the top of their front pages are the three credit-bureau FICO scores along with their last updates, followed by access to the unlike FICO scores for everything from getting a mortgage to a car loan.

The loan and mortgage calculators that use estimated rates based on your credit scores are available in both the apps and the online browser interface.

As the leader in credit scoring, Fair Isaac has a large Education section on the MyFICO site. The section has a Q&A section to explicate FICO scoring and lots of information almost how to improve credit scores and how to correct errors. My favorite part was the glossary that defined many central credit terms most people have never heard of.

MyFICO: Counterfoil

Getting complimentary of MyFICO tin can be done by calling its hotline or using the My Subscriptions portion of the interface. At the bottom right of the front page is a spot to cancel your subscription, but be ready for an ominous warning nigh the grave consequences of your determination.

I got an on-screen confirmation of my MyFICO cancellation likewise as an emailed confirmation, but the counterfoil didn't take effect until the end of the electric current billing cycle.

MyFICO review: Bottom line

MyFICO Premier's power to provide the exact criteria used past banks and credit-carte du jour companies to determine your credit scores is refreshing and useful, but the 28 dissimilar FICO scores you meet tin can be too much.

The service also lacks many of the mainstays of identity-theft-protection, such every bit alerts most address changes and information breaches. For those, we recommend IdentityForce UltraSecure + Credit or LifeLock Ultimate Plus. And while MyFICO's family plan lets you cover a lot of children, then do other services that cost much less.

Merely if y'all want to stay light amplification by stimulated emission of radiation-focused on your FICO credit scores, how they're used and how to make them improve, and then MyFICO is for you lot.

Source: https://www.tomsguide.com/reviews/myfico

Posted by: watsonhicamen.blogspot.com

0 Response to "MyFICO Premier identity theft protection review"

Post a Comment